Best Practices for After-Tax Contributions and IRS Form W-2

Pentegra recently received a question from a financial advisor who asked: “My client has made non-Roth, after-tax contributions to his 401(k) plan for 2023. Will those amounts be reported on his Form W-2 and, if so, where?”

The answer to the first part of the question is “maybe.” Your client will want to discuss this question with his employer and tax advisor for a definitive answer.

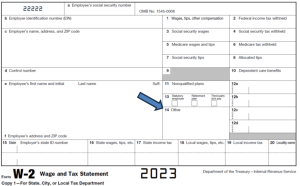

Generally, according to the instructions to IRS Form W-2, Wage and Tax Statement, an employer may, but is not required to, report non-Roth, after-tax contributions on Form W-2 in Box 14.

As you will see when you look at Form W-2, Box 14 serves as a “catch-all” for several miscellaneous types of plan contributions, including after-tax contributions, nonelective employer contributions made on behalf of an employee, required employee contributions and employer matching contributions. An employer may also use this box to report any other information that it wants to give to an employee, including items such as state disability insurance taxes withheld, union dues, uniform payments, health insurance premiums deducted, nontaxable income, educational assistance payments, or a minister’s parsonage allowance and utilities. Each distinctive item listed in Box 14 should be labeled.

Because Form W-2 may not be a reliable source for tracking after-tax contributions, a best practice for a plan participant would be to keep his or her own records and double check them against what the plan’s recordkeeper shows. If there is a discrepancy, a plan participant should immediately alert the plan sponsor and recordkeeper, and work to resolve any differences.

Conclusion

According to the Form W-2 instructions, employers may, but are not required to, report non-Roth, after-tax contributions on Form W-2 in Box 14. Consequently, Form W-2 may not be a reliable source for tracking after-tax contributions and participants should monitor their plan account information carefully and keep personal records as a way to double-check for accuracy.

The information set out herein is for general information only and is not intended to provide specific advice or recommendations for any individual or entity. Nothing herein constitutes or should be construed as a legal opinion or advice. You should consult your own attorney, accountant, financial or tax advisor or other planner or consultant with regard to your own situation or that of any entity which you represent or advise.