Defined Benefit Plans are Making a Comeback – Here’s Why

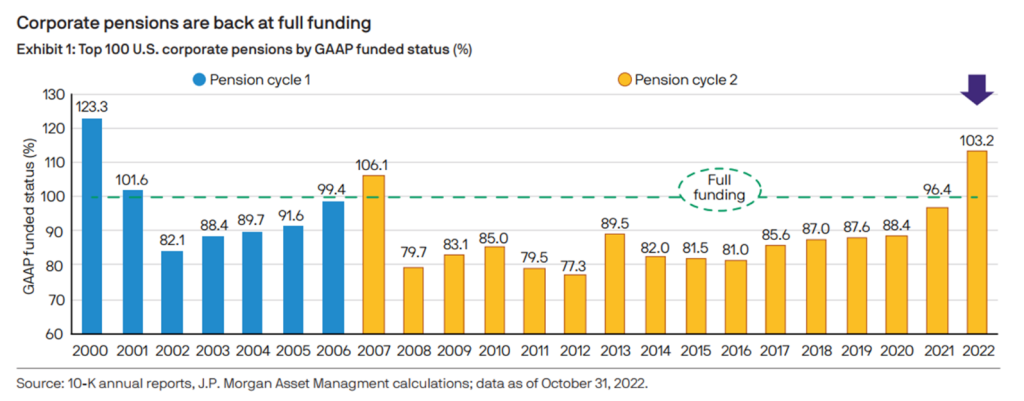

For over 50 years, the Defined Benefit (DB) pension plans have served as the cornerstone to an employer’s retirement program. In fact, during the 80’s and 90’s most plans were overfunded, allowing employers to maintain these plans with little to no out of pocket contributions. Life changed in the 2000’s and beyond as the market struggled and liability interest rates hit rock bottom.

Forces caused many employers to reconsider their DB plans, taking several different actions to reduce costs. Some plans were redesigned to lower benefit accruals, others either soft froze, eliminating new hires from participation, or hard froze, eliminating benefit accruals altogether going forward. If costs were not an issue, most employers would still have a Defined Benefit plan as the cornerstone of their retirement program.

Today, however, due to rising interest rates, beneficial regulatory pension relief, COVID-19 induced changes in our work environment and the hiring challenges many employers face, the defined benefit plan may become a game changer for many employers.

What Has Changed?

The Hiring Environment and Talent Shortage

COVID has changed the way we work. Many employees now expect to work remotely and have greater flexibility in their chosen work environment. Employers are finding it more difficult to find the talent they need as many employees have either left the work force or have increased their salary demands, keenly aware of employers’ challenges. Employers must find new ways of differentiating themselves when attempting to attract and retain the talent they need to be successful.

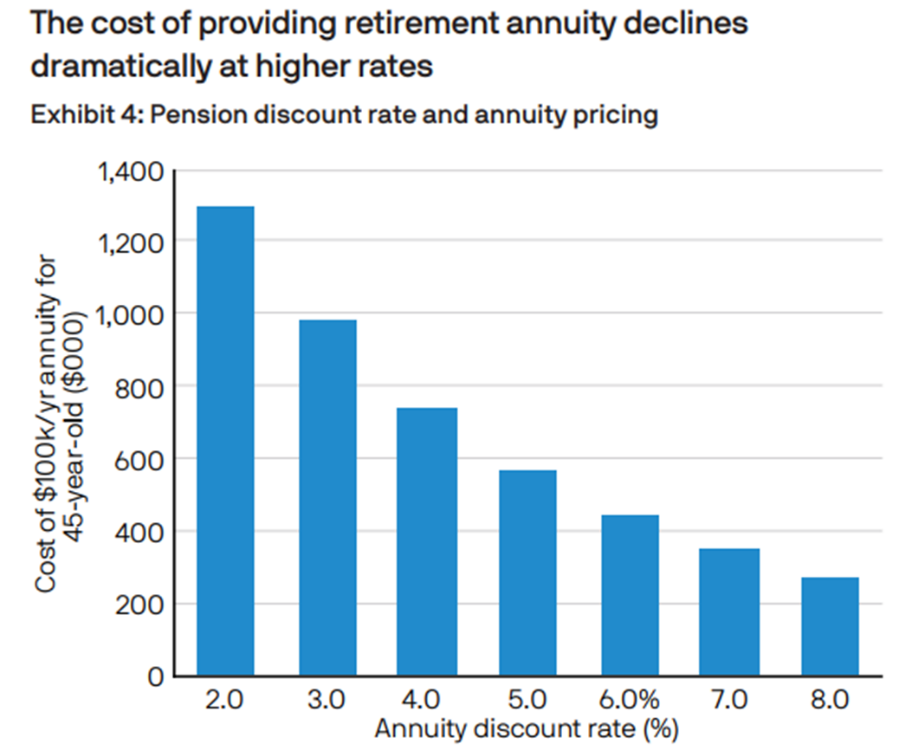

Regulatory Pension Relief

Liability interest rates have been a key driver of pension cost and volatility, the lower the rate, the higher the cost. Congress has addressed this concern several times over the years with various pieces of pension legislation, which kept the liability interest rates used for funding purposes high compared to actual short-term rates. The most recent pension legislation, the American Rescue Plan Act (ARPA), was signed into law in April of 2021. The law had several positive impacts on pension costs but one of the most significant changes was establishing a floor liability interest rate.

ARPA helped to address funding volatility caused by interest rate changes by establishing a 5% floor interest rate to calculate ongoing liabilities. Subsequently, in November 2021 additional pension relief was provided by extending these smoothing provisions until 2035. Many plans will become overfunded again due to rising rates and legislative changes, reducing minimum contribution requirements and providing predictable cost levels.

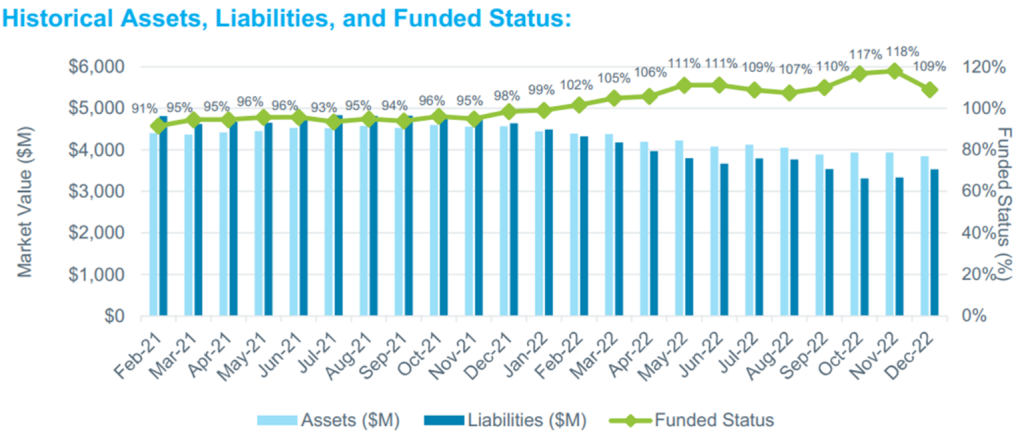

Liability Driven Investing

While this strategy may be new to others, Pentegra has been incorporating this investment technique for over 50 years. Essentially, the strategy minimizes funding fluctuation by matching assets and liabilities. The development of a Cash Flow Match, a dedicated, high-quality bond portfolio, was structured to match the future cash flow from coupons and bond maturities against future cash payments to retirees and beneficiaries. The primary benefit is to reduce pension contribution fluctuations so employers have a smoother, consistent contribution requirement.

Plan Design Options

Unlike market performance and interest rates, employers have significant control over plan design features. Traditional Defined Benefit plans were based on formulas which matched accrual rates and service with final pay provisions. Using final pay averages caused plan cost to increase over time, sometimes significantly and rapidly depending on pay increases and longevity.

To mitigate the rapid cost increase plans can use a career average salary, much like 401(K) plans do. Whether this gets coupled with a traditional formula design or uses a Cash Balance design, the result is a lower, more consistent and predictable level of costs.

Within the Cash Balance design, we can go one step further by minimizing the investment performance impact on costs. The plan can be designed to tie the earnings credited to accounts to the actual yearly earnings of the plan.

Variable annuity plans can create the additional advantage of varying accruals each year based on an employer’s financial performance. And many options exist for basing benefits on different levels of compensation- from base pay only plans to adding overtime, bonuses and/or commissions.

SECURE 2.0 ACT of 2022

The SECURE 2.0 Act of 2022 (SECURE 2.0) was signed into law on December 29, 2022. The Act contains several provisions favorable to Defined Benefit pension plans. The Act caps the PBGC Variable Rate Premium (VRP) at $52 per $1000 of Unfunded, Vested Benefits (UVBs). In years prior both the flat rate premium and the VRP were indexed for inflation. SECURE 2.0 also limits the rate by which mortality is projected to improve. Increasing PBGC premiums have discouraged new plan formation and encouraged plan freezes and terminations.

Historical Funding Levels

Rising Interest Rates

Short term interest rates have risen almost 200 basis points in the last 12 months. As interest rates rise, liabilities fall. Generally, rising rates reduce liability values faster than asset values, resulting in improved funding ratios. As a result, active pension plans can finance new benefits at a lower cost.

Defined Benefit vs. Defined Contribution Plans

Providing the same level of benefits under both Defined Contribution (DC) plans and DB plans is less costly under DB plans, as excess investment returns offset employer costs.

DC plans, in general, provide lower benefits as they are typically based on a career average salary. DB plans have tended to base benefits on final pay. As a result, DB plans have typically been more generous for employees and expensive for employers. DB plans provide monthly income for life providing greater security, although there is pressure on DC plans to incorporate an annuity option.

The DB investment risk is with the employer while the DC investment risk is with the participant. DB benefits are insured by the PBGC, while DC benefits are not insured.

Retirement Benefits and Security at Risk (3-legged stool concept)?

Pillar 1: Social Security

- Social Security represents one-third of income for those over 65; excluding wages, it accounts for over 40% of income

- The OASI Trust[1] is expected to be depleted by 2034, potentially leading to reduced or delayed benefits

- Nearly 50% of millennials don’t believe they’ll “see a dime” from social security

[1] The Old-Age and Survivors Insurance (OASI) Trust Fund is a separate account in the U.S. Treasury that pays benefits to retirees and other beneficiaries.

Pillar 2: Employer-Sponsored Retirement Plans

- Shift from DB to DC plans has placed a higher burden on employees and led to lower levels of income replacement

- DC plans are often costlier to employers than comparable well-run DB plans as favorable investment returns can reduce the cost of DB plans

- Maintaining a DB plan has both economic and social benefits to employees and employer

Pillar 3: Individual Savings

- The personal savings rate in the United States has been on the decline over the last 50 years

- After a spike during COVID-19, the rate has declined around 5%, a level consistent with income replacement of 10%-30%

Source: J.P. Morgan Asset Management, U.S. Bureau of Economic Analysis-Personal Savings Rate, U.S. Census Bureau 2021 Current Population Survey, the Nationwide Retirement Institute’s 2022 Social Security Survey, 2022 Supplemental Security Income annual report.

Perspective– Are Defined Benefit Plans Valued by Employees?

- It is more difficult to appreciate DB benefits as they have been typically expressed as an accrued benefit

- Surveys show that workers under 30 change jobs frequently, losing the value of the DB plan

- However, surveys also indicate that employees dissatisfied with their retirement program are even less likely to stay

- 86% of young workers say retirement portability is a high priority

- 85% say receiving a fixed, lifetime benefit is a high priority

- Inadequate retirement benefits was a prime reason over 40% of private sector employees left jobs in 2021

Frozen Plans – Reconsiderations

Since 2000, many employers have reduced benefits under their Defined Benefit plans, eliminated new hires from participation or froze their plans altogether (no further benefit accruals for any participant). With real market interest rates beginning to rise, employers may want to consider a new strategy- resuming accruals under the plan.

Consider this: Millions of workers today may not have enough money to sustain themselves during their retirement years. Studies continue to show that even with 401(k) plans and Social Security; many Americans will not have enough retirement income to meet reasonable lifestyle goals. The causes are multiple – longer lifespans, fewer/lower pension benefits, reliance on defined contribution plans and volatile markets. Add the threat to our Social Security program and the future retirement of our aging population will be challenging for many. Experts feel we will need 70-90% of our pre-retirement income to maintain our lifestyles in retirement. The question: Who is going to pay for this shortage in employee retirement income?

Defined Contribution plans, such as the 401(k) plan, were never intended or designed to replace the Defined Benefit plan—they were meant to supplement it. 401(k) plans permit access to funds while employed and experience shows that many employees draw on these plans to pay for college education, medical expenses and even home ownership. Couple these limitations with the fact that 401(k) plans place all the investment risk on the employees. We have asked today’s employees to not only shoulder the responsibility for their own retirement well-being but to become professional money managers at the same time.

The solution: Defined Benefit plans provide an ideal way to help your participants build a secure future. There is simply no better plan in terms of meeting the goal of income replacement at retirement, particularly when you look at how much participants would have to save on their own to match the benefits provided by a pension plan. A pension plan provides a guaranteed, secure income that participants cannot outlive and it places the responsibility of managing the assets into the hands of professional money managers. And certain designs, like the Cash Balance Plan, can look and feel like a stated ‘account balance’ Defined Contribution plan feature, thereby increasing employee appreciation.

Beyond that, these plans provide important advantages to the employer.

Defined Benefit plans:

- Reduce employee turnover, thereby reducing costs to acquire new talent

- Attract and retain employees, ever more important in today’s hiring environment

- Provide lifetime income and may provide inflation protection

- Provide PBGC insured benefits

- Provide more comprehensive benefit coverage

- Offset employer costs by favorable investment performance

- Facilitate orderly retirement and succession by providing participants with the financial ability to retire

The retirement landscape has changed. Rising rates, pension regulatory relief, workplace challenges and new plan design options make this an ideal time to revisit the benefits of a defined benefit plan. For the 50-60 years following the Great Depression, Defined Benefit plans were the mainstay of corporate retirement efforts and provided the foundation for a secure retirement future. Why? Because Defined Benefit plans provide a known level of guaranteed income that employees cannot outlive and the benefits produced by these plans for participants are not subject to market volatility. Defined Benefit plans were, and still are, the most cost-effective program available when it comes to providing income replacement at retirement and can provide economic, strategic and social benefits to employers and employees.

Developing the right “benefits blend” for your organization involves addressing not only adequacy and competitive considerations but also cost considerations. Benefit programs can be restructured and modified to meet your organization’s cost and benefit objectives. Your benefits program has implications at all levels of your organization.

About the Author