New Incentives for Small Businesses When Starting a Workplace Retirement Plan

A sweeter tax deal may await you as result of law changes if you are a “small” business owner who does not currently offer a workplace retirement plan. By small, I mean businesses with 50 or fewer employees. Section 102 of the SECURE Act 2.0 of 2022 (SECURE 2.0) enhances and expands the tax credits available for your business if you establish a new simplified employee pension (SEP), savings incentive match plan for employees of small employers (SIMPLE) plans or qualified retirement plan like a 401(k) plan.

First, for businesses with up to 50 employees without a retirement plan that establish a SEP, SIMPLE IRA or 401(k) plan, Section 102 of SECURE 2.0 increases the small plan startup tax credit from 50 percent to 100 percent of eligible costs (capped at $5,000 per year) for the first three years the plan exists. (Prior rules still apply for those with 51-100 employees.)

More precisely, the enhanced credit is 100 percent of the eligible startup costs, up to the greater of:

$500; or

The lesser of

- $250 multiplied by the number of non-highly compensated employees (non-HCEs) who are eligible to participate in the plan, or

- $5,000.

Other eligibility rules include

- The business had at least one plan participant who was a non-HCE;

- The business has 100 or fewer employees who received at least $5,000 of compensation from the employer in the preceding year; and

- In the three tax years before the first year the business is eligible for the credit, the covered employees were not substantially the same employees who received contributions or accrued benefits in another plan sponsored by the business.

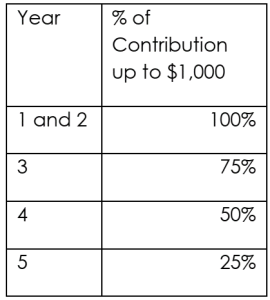

Second, the new law also added an additional credit exclusively for defined contribution plans with 50 or fewer employees. The credit is equal to a percentage of the amount you, as the employer, contribute on behalf of employees, up to a per-employee cap of $1,000. Employees with compensation in excess of $100,000 are excluded from the calculation. This credit applies for five years and is phased out for employers with between 51 and 100 employees.

But don’t forget about the third potential plan startup credit that exists under the old rules, which are still applicable. An eligible employer that adds an eligible automatic contribution arrangement (EACA) feature to its plan can claim a tax credit of $500 per year for a three-year period beginning with the first taxable year the employer includes the EACA .

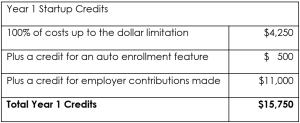

Let’s talk numbers with an example. Consider the following scenario:

- In 2023, Newbie Inc., sets up a new EACA 401(k) plan with a 100% match up to 4% of compensation.

- The company has 19 employees: 17 are non-HCEs and 2 are HCEs.

- There are 8 employees with compensation over $100,000 and there are 11 employees each with compensation between $25,000-$100,000.

- Newbie Inc.’s, total startup costs for Year 1 = $7,500

Credit #1 Startup Credit

Newbie’s credit is subject to a dollar limitation, which is the greater of $500 OR the lesser of A or B.

- $4,250 (i.e., $250 x 17 non-HCE participants) *

- $5,000

Result= $4,250 (greater of $4,250 OR $500)

*20-50 non-HCEs would impose the $5,000 yearly cap (Maybe state that if plan covered 21 or more NHCEs, the $5,000 cap would be triggered)

Credit #2 Auto Enrollment

Credit for auto enrollment feature = $ 500

Credit #3 Employer Contributions

11 employees with comp < $100K x $1,000= $11,000

Businesses will likely use an updated version of Form 8881, Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment to claim the credits.

What about businesses that will join or have joined multiple employer plans (MEPs) or Pooled Employer Plans (PEPs)? Fortunately, Section 111 of SECURE 2.0 ensures the startup tax credit is available for three years for employers joining a MEP or PEP, regardless of how long the MEP or PEP has been in existence. The three-year auto-enrollment credit will also apply to eligible employers who join a MEP.

The enhanced plan startup credit and credit for employer contributions for businesses with 50 or fewer employees is effective for the 2023 and later tax years. How do these changes impact plans started a year or two ago; are they simply out of luck? If a business established a plan within what we call “the establishment window” (i.e., three years to be eligible for the startup and auto enroll credit, and five years to be eligible for the employer contribution credit), and it meets the other eligibility criteria mentioned earlier, it would be eligible to claim the credits for the years remaining in the establishment window.

Returning to our prior scenario, let’s say that Newbie, Inc., had set up its plan in 2021. Newbie would be able to claim the enhanced startup tax credit for one year—2023, and the new employer contribution credit for 2023-2025. If Newbie was an eligible employer in 2021 under the startup credit rules in effect prior to the SECURE 2.0 Act changes, it would have applied 50% (rather than 100%) when calculating the maximum credit amount for 2021 and 2022. Newbie would also have been able to claim the $500 auto-enroll credit for 2021 and 2022.

About the Author